Introduction

Sri Lanka is an island nation which is having a Gross Domestic Product (GDP) of USD 87.2 billion, and exports of goods and services contribute 21.9% to the GDP. Government of Sri Lanka has faced budget deficits since 2007 and forced to borrow from international capital markets in the form of term financing facilities and sovereign bonds. Current outstanding debt amounts to USD 27,791 million and China had lent merely 10% of it. Whereas countries like Japan, India, and multilateral agencies such as Asian Development bank (ADB), International Development Association (IDA) have lent us 90% of the debt currently owed by Sri Lanka. Now, Sri Lanka is caught in a cycle of ever-increasing borrowings to pay off past debts and finance current deficits.

Since 2013, China became the largest source of Foreign Direct Investment (FDI) for Sri Lanka by investing in major infrastructure projects. Hambantota port was one of them and both phase I and phase II were funded by China Ex-Im bank. By mid-2016, Sri Lanka faced balance of payment crisis and Government had to raise much needed US dollars by any means to avoid default. This is the main reason for leasing Hambantota port to a private entity for 99 years and gaining USD 1.12 billion for 80% of its equity. This cash inflow was essential for Sri Lanka at the time to tackle the balance of repayment crisis which was looming. China Merchants Port Holdings had proposed to replicate “Port + Zone + City” model with Hambantota port and develop an economic zone leveraging the port. India, and other western countries severely criticized this lease agreement stating security reasons that China will use Hambantota port as a military base for its navy. Now, this port is being stated as an example by the criticizing countries for the “debt trap diplomacy” used by China under the cover of Belt and Road Initiative (BRI). Feasibility studies showed that Hambantota port had to operate under Phase I stage until it gained revenue through operations before stating the Phase II work. But, due to political reasons Phase II was started ten years ahead of the original timeline. Status is that Sri Lanka do not have the financial capability to invest in the port’s infrastructure needs which are essential to operate and do not have human resource who has the “know-how” to manage this type of port. At present Sri Lanka Port Authority and China Merchants Port Holdings have created a joint entity called Hambantota International Port Group to operate the Hambantota port.

Analysis

The external environment includes all elements existing outside the boundary of the Hambantota Port that have the potential to affect the port. Not going to analyze the task environment of the Hambantota Port since this is an infrastructure project managed by Government. But the general environment’s effect on the initiation and development of the project is visualized through the PESTEL analysis.

| Political President Rajapaksha’s desire to promote Hambantota as an urban city. Strategic decision to have a second port to remove reliance on Colombo port. Lack of interest by Indian and American governments to invest in Phase I of the project. Less rules regarding governance and repayment of loans by the Chinese government. | Economical Declining annual GDP growth and successive budget deficits. Accumulated foreign debt which restricts further borrowing and repayment schedules. High inequality in wealth sharing among the population (0.45 Gini coefficient). China became the largest trading partner for Sri Lanka in 2016. Economical slowdown in Western and Indian economy. |

| Social High unemployment rate in the southern province, fueled infrastructure development in those areas. | Technological Lack of knowledge on operating a large-scale niche port which directed towards obtaining external help in operating. |

| Environmental International Maritime organization’s (IMO) direction towards having sustainable ports with less marine pollution. | Legal India’s cabotage law demands a higher volume transshipment port in the vicinity. |

Next let us focus on the Hambantota port’s individual characteristics by conducting SWOT analysis.

| Strengths Natural deep-water terminal facility to berth large ships with ease and efficiency. Located within ten nautical miles from East-West Indian Ocean shipping line. Availability of vast area of land surrounding the port for port related industrial development. Dry weather throughout the year. Competitive local labor costs. Experience of China Merchants Holdings regarding operating seaports. | Weaknesses Need extensive investment to develop the port’s essential infrastructure. Lack of local resource personnel to manage and operate the port. Phase II started prior to its original timeline. Annual repayment of loans taken to fund Phase I and Phase II. |

| Opportunities Colombo port experiencing congestion in operation due to inefficiency. Existing gap in the port infrastructure within Southern Asia. Option to develop according to IMO’s sustainable initiatives. High demand for transshipment hubs in the region to cater developing economies such as India, Bangladesh, and Eastern Africa. Demand for ship related services such as bunkering and maintenance near the existing busy shipping line. Demand for port facilities with Industry 4.0 technology. | Threats International backlash on Belt and Road Initiative (BRI) and sanctions by opposing countries. Security concerns of neighboring countries. Potential gated community of Chinese population within port economic zone. |

Government of Sri Lanka looked at Hambantota port Phase I as a strategic development investment to induce economic development in Southern province. Since, India and America did not invest in the project, Government of Sri Lanka turned towards Chinese investment and started the project. But Phase II was started prematurely by obtaining loans again from Chinese entity for political reasons and lack of operational efficiency and “know how” have made the Hambantota port as a white elephant investment in the country. After president Sirisena took reins, Hambantota port facility was looked like an asset to lease to an investor to gain much needed foreign exchange. Again, India rejected the idea of investing in the port thus enabling Sri Lanka Port Authority to form a partnership with China Merchants Holdings. Due to India and other western countries security concerns Government of Sri Lanka included clauses to prevent unannounced military vehicle presence in the port premises. So, now the Hambantota port is leased to the China Merchant Holdings for 99 years under Supply-Operate-Transfer arrangement.

Colombo port being the only international port in the country and facing congestion in operating cargo, Sri Lanka needs a second port to tap into the existing demand for marine operations. As mentioned in the SWOT analysis, Hambantota port is in a strategic location to easily cater one of the busy shipping lines in the world. This should be utilized to the maximum to generate revenue. With Asian region facing economic growth in future there will a gap in infrastructure for supply chain facilities and currently Hambantota port is in advantageous position to utilize that. Since, IMO is regulating the industry with sustainable initiatives, as a developing port facility Hambantota port offers external organizations to situate their facilities in our country. China Merchants Holdings brings their experience in operating and developing such ports to the table and Sri Lanka Port Authority can depend on that to identify and engage in different business models to generate revenue. International backlash towards BRI is a main concern to consider since, Sri Lanka depends on thriving as a transshipment hub and service provider to other nations. Apart from those concerns regarding the national security and China using the port facility as a military base should be tackled properly to gain the trust of India and neighboring countries. Another major threat in consideration would be the labor migration from China towards Hambantota port. This might create a Chinese community within port facility which can have detrimental effect towards social harmony. But there is pressure towards the management to generate revenue as soon as possible since the initial loans must be settled in time.

Conclusions and Recommendations

Sri Lanka is currently facing financial hardship and is not able to refinance the current operations or initiate Phase III of the plan. But Hambantota port has opportunities to be successful in the market if the weaknesses and threats are managed properly. The future should align with promoting the strengths of the Hambantota port and develop business models leveraging them.

Hambantota port should focus on implementing Phase I, which revolves around dry bulk terminal, liquid bulk terminal, break bulk terminal, roll-on / roll-off terminal and ship bunkering and servicing facilities. Recommend to market on roll-on / roll-off terminal service since Hambantota port has vast storage space compared to Colombo port to handle that type of cargo. Hambantota port management can also use this as a transshipment hub for vehicle manufacturers and can provide value adding services to them prior to reach their destination. Since located in the midway between Singapore and Fujairah, management can market themselves as the location offering bunkering services to the passing ships. This will allow the ships to avoid the detour to Colombo to make such calls.

Phase II of the project involves handling containerized cargo and China Merchants Holdings will invest in the equipment needed to perform that. Recommend developing the area around the port facility with infrastructure which will attract investors to set up their manufacturing facilities in the economic zone. This can be collaborated with the Board of Investment (BOI) and create an easy and linear process to get approval to set up facilities in the zone. So that Hambantota port can export these products from the zone which gives the purchaser a low transiting time.

To achieve these Hambantota port management needs to use their existing knowledge and bring their own skilled workers from China to operate the port. So, Sri Lanka Port Authority should develop a framework to train local labors through these migrant skilled labors which will allow the management to take advantage of comparatively low labor cost. This will also allow the local employees much needed knowledge to develop other ports in the country without the help of external parties. This framework will eventually reduce labor migration for non-essential work from China and create more employment opportunities for local population. Apart from utilizing the existing opportunities and strengths of the port, the Hambantota port management should initiate feasibility studies on below programs which can uplift the market demand for their services among shipping companies.

- Collaborate with International Maritime Organization and discuss their future sustainable initiatives with respect to marine traffic. This will shed light on new regulations which are expected to be implemented in future. Then utilize that information while developing the infrastructure of the port at present.

Example: Promoting Hambantota port as a Green Port in region, creating storage facilities to cater new types of fuels

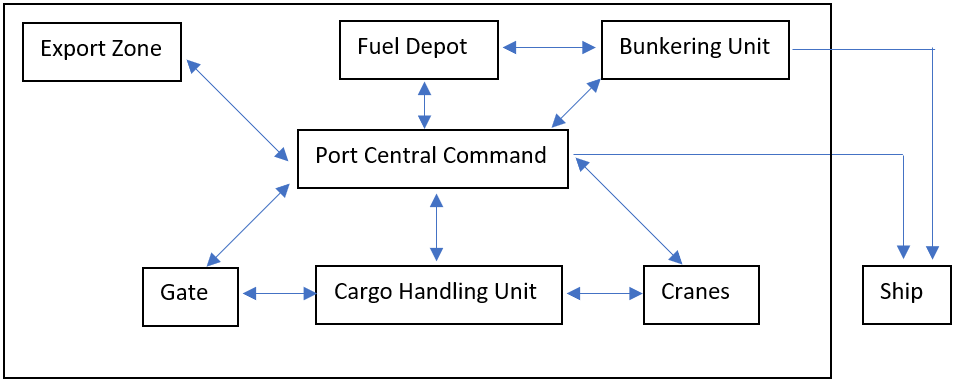

- Introducing Industry 4.0 technology to Hambantota port operations. This can be implemented in stages, but eventually this interconnected smart equipment will help to achieve high efficiency in operation, minimal maintenance cost for the machinery, low emission from port activities, and high volume handled with in a period. Figure below shows the potential interconnected units we can have in a port.

As a developing country Sri Lanka needs a second port which can bring in more foreign exchange and we must leverage this infrastructure available now to set up an export-oriented zone to gain development. By developing proper business models with respect to the strengths Hambantota port can attract more clients to its shore. Further, after Phase III is materialized Hambantota will be transformed to an urban city which has an active economy depending on the port. Hence, investing in sustainable port operations and Industry 4.0 is essential to tackle the future supply chain requirements.

Modern Talking был немецким дуэтом, сформированным в 1984 году. Он стал одним из самых ярких представителей евродиско и популярен благодаря своему неповторимому звучанию. Лучшие песни включают “You’re My Heart, You’re My Soul”, “Brother Louie”, “Cheri, Cheri Lady” и “Geronimo’s Cadillac”. Их музыка оставила неизгладимый след в истории поп-музыки, захватывая слушателей своими заразительными мелодиями и запоминающимися текстами. Modern Talking продолжает быть популярным и в наши дни, оставаясь одним из символов эпохи диско. Музыка 2024 года слушать онлайн и скачать бесплатно mp3.